Home Equity Loan Vs Credit Card

If you're looking for a loan to renovate your home or pay down another debt, you might have an opportunity to use the equity you've already invested in your home. read on to learn more about home equity loan requirements and answer your hom. The main drawback is that, unlike home equity loans, a credit card won’t home equity loan vs credit card qualify you for any sort of tax deduction. they could also lead to frivolous spending if you don’t have a tight rein on your budget.

Mar 08, 2021 · a home equity loan is one way to pay off credit card debt. home equity loans generally charge much lower interest rates than most credit cards. the danger of a home equity loan is that you could. Unlike a conventional loan, a home equity line of credit is something you establish ahead of time and use home equity loan vs credit card when and if you need it. in that way, it’s a little like a credit card, except with a heloc, your home is used as collateral. a heloc has a credit limit and a specified borrowing period, which is typically 10 years. Whether you are looking to apply for a new credit card or are just starting out, there are a few things to know beforehand. here we will look at what exactly a credit card is, what the benefits and detriments to having one are, what first-t. Unlike a conventional loan, a home equity line of credit is something you establish ahead of time and use when and if you need it. in that way, it’s a little like a credit card, except with a heloc, your home is used as collateral. a heloc has a credit limit and a specified borrowing period, which is typically 10 years.

Home Equity Loan Vs Credit Card Yahoo Answers

Whether you’re starting your own small business or you’re already running one, its continued financial health is one of the most important things to keep in mind. for some extra security to fall back on if times get tough or to help build y. Getting a new car (or just new to you) can be exciting, but it also brings some pressure if you don’t have the funds to pay for the car outright — and most people don’t. of course, financing options are plentiful for vehicle purchases for p. Consolidating loans like credit cards and auto loans can be risky when you use home equity. by pledging your house as collateral, you may turn unsecured loans into secured debt. but a home equity loan can convert high-interest-rate debts to a low, fixed rate. the resulting savings may be significant—but make sure you don’t go back into debt. if you're susceptible to that, the one-chance. A home home equity loan vs credit card equity loan is one way to pay off credit card debt. home equity loans generally charge much lower interest rates than most credit cards. the danger of a home equity loan is that you could.

Using A Home Equity Loan To Pay Off Credit Cards Quickly

Credit cards allow for a greater degree of financial flexibility than debit cards, and can be a useful tool to build your credit history. there are even certain situations where a credit card is essential, like many car rental businesses an. Getting a credit card is a fairly straightforward process that requires you to submit an application for a card and receive an home equity loan vs credit card approval or denial. the result of an application is mostly based on your credit score, although other factors are. A secured credit card can be a helpful tool if you're trying to build or repair your personal credit profile. you put down a refundable deposit — which becomes your spending limit — on a secured card and use it just like a credit card, repa. Search for relevant info & results. get results from multiple engines.

Pros and cons of using a home equity loan to pay credit card debt. using a home equity loan to pay credit card debt may allow you to get rid of multiple payments and lock in a lower interest rate. depending on the lender and the terms of the loan, a borrower can have funds in hand in as few as two weeks, although 30 to 45 days is more typical. A popular option is a home equity line of credit, also known as a heloc. heloc funds are secured based on the amount of equity you have in a home, which makes it similar to a home equity loan. but it's also like a credit card because you have a revolving line of credit. helocs are preferred by many homeowners because they allow you to use the. Find home loan with equity. find quick info from multiple sources. A home equity loan. this is a second mortgage on your home, which gives you a lump sum to work with. a home equity line of credit, also known as a heloc. it's essentially a credit card backed by your home as collateral, which allows you to charge payments for one or more renovation projects as you need the money.

Search Find Now

1000 expert writers.

Instant Results

Having a bad credit score can make getting a loan challenging, but there are still options if you find yourself in a pinch. from title loans to cash advances, there are a number of ways to borrow money with bad credit. however, these method. Home loan with equity this is what you're searching for!. Heloc vs. credit card: why the plastic may work out better last updated on march 29th, 2018 you may have heard recently that “tappable” home equity has reached an all-time high, thanks to rapidly appreciating home prices and conservative borrowing on behalf of existing homeowners. Apr 16, 2019 · the main drawback is that, unlike home equity loans, a credit card won’t qualify you for any sort of tax deduction. they could also lead to frivolous spending if you don’t have a tight rein on your budget.

How To Get A Credit Card

I suggested taking a home equity loan of roughly $10,000, our house appraisal is at 220,000 and our mortgage remaining is 163,000. i won't get back the full $10,000 but i can get a lower interest rate than our 19. 9% on our credit cards and i can deduct the interest paid. Home equity lines of credit, in contrast, work similarly to credit cards. homeowners are extended up to a certain amount in home equity loan vs credit card equity, and individuals treat the loan as a revolving line of credit. they can borrow as much or as little as their limit allows and they have a monthly payment each billing cycle and a minimum amount they must pay. however, these lines of credit carry a variable interest.

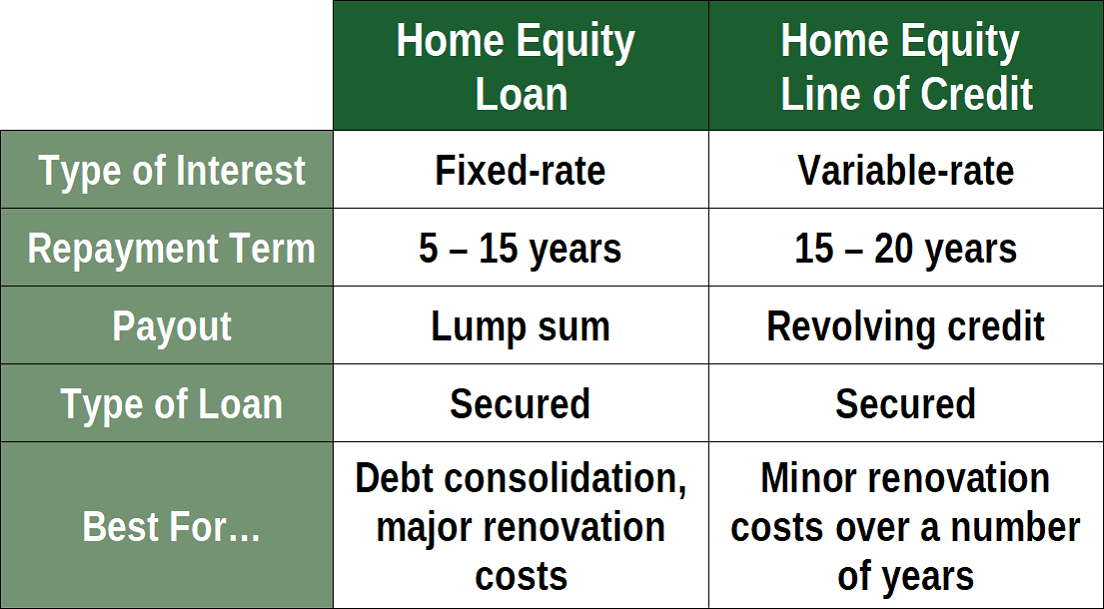

If you're thinking about using the equity in your home to meet your financial needs you have options. compare the differences between a home equity loan vs. a home equity line of credit and see what might make sense for you. Mar 29, 2018 · heloc vs. credit card: why the plastic may work out better last updated on march 29th, 2018 you may have heard recently that “tappable” home equity has reached an all-time high, thanks to rapidly appreciating home prices and conservative borrowing on behalf of existing homeowners. Homeowners used to be able to deduct the interest on a home equity loan or line of credit no matter how they used the money—be it on home improvements, or to pay off high-interest debt, such as.

Find home equit loan and related articles. search now!. Some people believe that you should avoid getting a credit card as they generate debt. however, without one you will be missing out as they offer protection when buying items online. they are also one of the best ways of spending when you j. For many people, one of the greatest achievements in life is owning a home. if you're one of the lucky few, your savings or a financial windfall will cover the cost of buying your home, but if you're among the masses, you will need to take.

Komentar

Posting Komentar